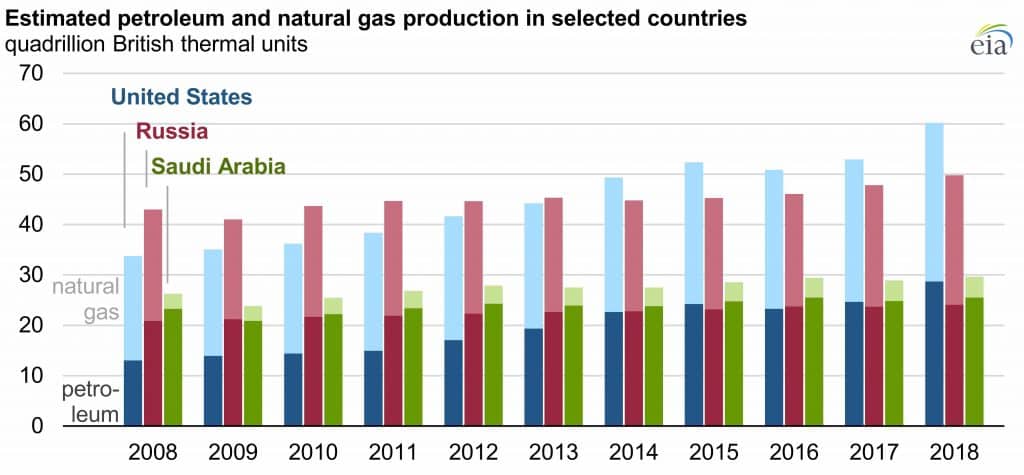

WASHINGTON, D.C. — The U.S. Energy Information Administration announced today that U.S. petroleum and natural gas production increased by 16 percent and by 12 percent, respectively, in 2018. These totals combined established a new production record, noted EIA.

Note: Petroleum includes crude oil, condensate, and natural gas plant liquids.

Note: Petroleum includes crude oil, condensate, and natural gas plant liquids.

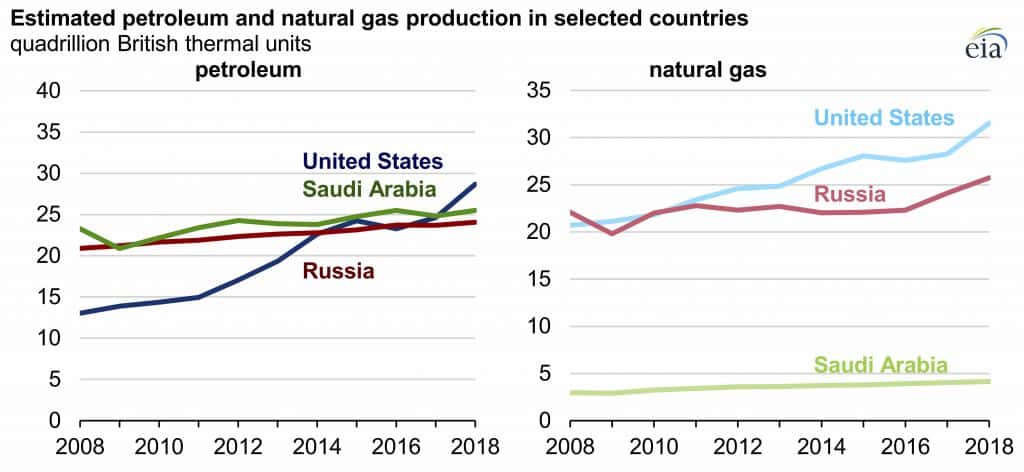

The U.S. surpassed Russia in 2011 to become the world’s largest producer of natural gas and surpassed Saudi Arabia in 2018 to become the world’s largest producer of petroleum. Last year’s increase in the U.S. was one of the largest absolute petroleum and natural gas production increases from a single country in history.

For the U.S. and Russia, petroleum and natural gas production are almost evenly split; Saudi Arabia’s production heavily favors petroleum. Petroleum production is composed of several types of liquid fuels, including crude oil and lease condensate, natural gas plant liquids (NGPLs) and bitumen. The U.S. produced 28.7 quadrillion British thermal units (quads) of petroleum in 2018, which was composed of 80 percent crude oil and condensate and 20 percent NGPLs.

U.S. crude oil production increased by 17 percent in 2018, setting a new record of nearly 11.0 million barrels per day (b/d), equivalent to 22.8 quadrillion British thermal units (BTU) in energy terms. Production in the Permian region of western Texas and eastern New Mexico contributed to most of the growth in U.S. crude oil production.

The U.S. also produced 4.3 million b/d of NGPLs in 2018, equivalent to 5.8 quadrillion BTU. U.S. NGPL production has more than doubled since 2008, when the market for NGPLs began to expand.

U.S. dry natural gas production increased by 12 percent in 2018 to 28.5 billion cubic feet per day (BCF/d), or 31.5 quadrillion BTU, reaching a new record high for the second year in a row. Ongoing growth in liquefied natural gas export capacity and the expanded ability to reach new markets have supported increases in U.S. natural gas production.

- Related: How to Find Alt-Fuel Stations

- Related: Summer 2019 Diesel & Gasoline Prices Forecast to be Lower

- Related: Have You Left Money Lying Around? A Look at California’s Clean Fuel Market

Russia’s crude oil and natural gas production also reached record levels in 2018, encouraged by increasing global demand. Russia exports most of the crude oil that it produces to European countries and to China. Since 2016, nearly 60 percent of Russia’s crude oil exports have gone to European member countries in the Organization for Economic Cooperation and Development (OECD). Russia’s crude oil is also an important source of supply to China and neighboring countries.

Russia’s natural gas production increased by 7 percent in 2018, which exceeded the growth in exports. The Yamal liquefied natural gas (LNG) export facility, which loaded its first cargo in December 2017, can liquefy more than 16 million tons of natural gas annually and accounts for almost all of the recent growth in Russia’s LNG exports. Since 2000, more than 80 percent of Russia’s natural gas exports have been sent to Europe.

Saudi Arabia’s annual average crude oil production increased slightly in 2018, but it remained lower than in 2016, when Saudi Arabia’s crude oil output reached a record high. Saudi Arabia’s crude oil production reached an all-time monthly high in November 2018 before the December 2018 agreement by OPEC to extend production cuts.

In addition to exporting and refining crude oil, Saudi Arabia consumes crude oil directly for electricity generation. That makes Saudi Arabian crude oil consumption highest in the summer, when electricity demand for space cooling is relatively high.

Since 2016, Saudi Arabia’s direct crude oil burn for electric power generation has decreased for a number of reasons. Those include demand reductions from a partial withdraw of power subsidies, greater use of residual fuel oil, and increased availability of domestic natural gas.

Crude oil exports account for about 60 percent of Saudi Arabia’s total economic output. China, along with Japan, South Korea, Taiwan and the U.S. remain critical markets for Saudi Arabia’s petroleum exports.